What to do when the bank says no.

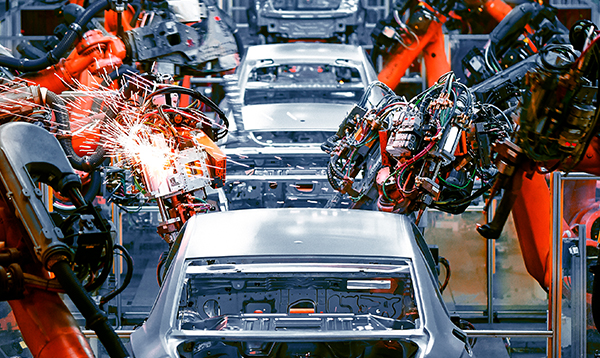

In an ever-changing and heavily regulated banking market, finding reliable funding can be challenge for companies who do not fit the traditional banking profile. If your credit history isn’t perfect, you are an early-stage business, or you have recent operating losses, you may be unable to qualify for financing. The experts at Utica Leaseco can help, with competitively-priced equipment loan and lease options.

Our Services.

We provide customized equipment loan and lease options from $300,000 to $25,000,000 for businesses of all sizes throughout the continental U.S. We finance up to 100% of the equipment value and offer extended terms to help add, replace or upgrade new and used equipment as well as refinancing options for more favorable terms or to free up capital. We have already funded over $400 million in leases and loans to help high-risk companies turn the corner and succeed.

Having the right equipment financing can free up capital for other business expenses, relieve budget stress with more manageable payments, and let you preserve your business credit line for other working capital needs. Our sister company, Utica Equipment Finance (UEF), specializes in providing credit-based equipment finance products from $1 million to $50 million to North American businesses with custom solutions that help you feel certain about your future.

Phone: (248) 710-2134

Phone: (248) 710-2134 info@uticaleaseco.com

info@uticaleaseco.com